Government Finances 2019-20

It’s that time of year again, when people start talking about what the Union Budget may bring in the shape of fiscal policy changes and what it will show about public finances in the previous year. But increasingly, such discussion reflects the triumph of hope over experience, since the Budget of the previous year have shown that we would be foolish to take the numbers seriously.

Last year was dramatic because the Finance Minister presented two Budgets that were both divorced from reality: one an “Interim Budget” on 1 February that made extravagantly optimistic guesses about numbers for the last quarter of the fiscal year 2018-19, and the later July Budget that presented completely false revenue and expenditure numbers for that same fiscal year. Since those inflated numbers were then used as the basis to arrive at Budget projections for 2019-20, there is little chance that those Budget estimates will be met in the current year.

The question of course, is whether the Finance Minister will once again choose to cover this up and mislead Parliament on the true fiscal numbers for 2019-20. The chances are that she will once again assume a very rosy picture of tax collection in the last quarter of this year, to generate revenues estimates that are unlikely to be met. Since Budget numbers can no longer be trusted, now we have to rely only on data from the Controller General of Accounts (www.cga.nic.in) to get the real picture.

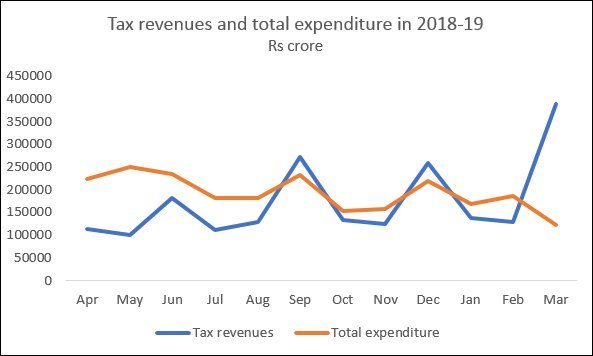

Figure 1: Expenditure was slashed in the last quarter of the previous fiscal year

because tax revenues were below projections

It is worth remembering that last year, while the Finance Ministry pretended that the tax revenues would recover so sharply as to meet the Budget estimates, it actually knew that this wold not happen, and therefore enforced a major cutback in public spending from January 2019 onwards. Figure 1 indicates the extent of the reduction, which meant that the stated fiscal deficit did not show as much overrun as would be expected. In a previous edition of MacroScan, we showed that this squeeze on public spending was not uniform, but was concentrated in the areas that matter most for people’s welfare: agriculture, food and consumer affairs, health, education, and the like.

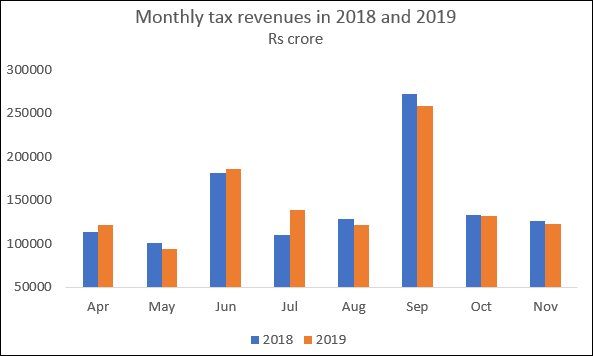

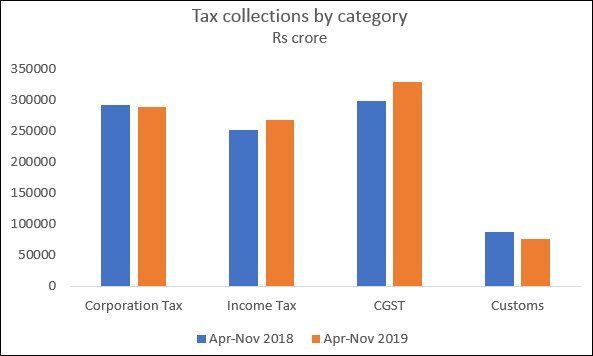

So what can we expect this year? The indications thus far are that tax collections are even more dismal than they were last year. Figure 2 shows that even nominal tax receipts barely increased and actually declined relative to the previous year for most months—a shocking comment on the depressed state of the economy and public finances. Figure 3 indicates that this decline was driven by corporation taxes (especially following the significant tax cut announced in September 2019) and customs duties.

Figure 2: Nominal tax receipts declined relative to the previous year for most months

Figure 3: Corporation tax and customs have declined in

nominal terms compared to last year

More recent data reported in the Indian Express suggest even worse declines in tax revenues by mid-January 2020. Apparently direct tax collections were down 5.2 per cent relative to the same period last year—which was itself a year of low tax collection. While the slashing of corporate taxes can be blamed to some extent, there is no doubt that the economic slowdown has been a chief contributor to this. And this is clearly playing havoc with the budget estimates, which were over-optimistic to start with. For example, personal income tax revenues were budgeted to increase by 23.5 per cent, but they had increased by only 6.5 per cent until 15 January.

It is now widely accepted that this context of economic slowdown driven by demand deficiency should be counteracted by fiscal stimulus, particularly by public spending that puts purchasing power in the hands of those who are most likely to spend immediately, and thereby generate positive multiplier effects. But somehow the Union government has been remarkably resistant to such measures. Instead, it is so obsessed with supposed fiscal discipline (in sham form, since it shifts a lot of spending off-budget) that it is actually intensifying the downturn by reducing its own spending. It is also preventing state governments from spending by denying them their rightful dues in terms of GST compensation and other tax revenues.

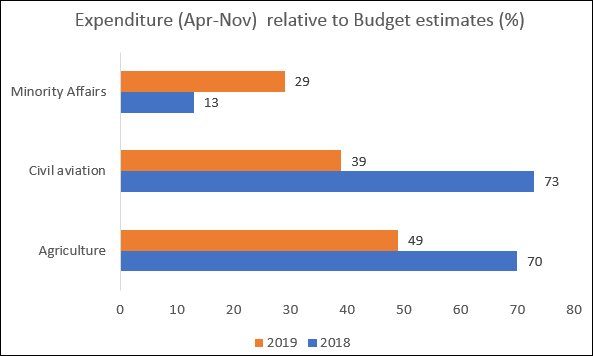

Figure 4: Some Ministries have already faced severe budget cuts

In the first eight months of the fiscal year, the government has spent only 65 per cent of its proposed budget, and it may well compress expenditure further. But once again this has not been uniform: Figure 4 shows how severe this cutback has been in some of the worst affected sectors, like agriculture (which is crying out for more public spending) and civil aviation (which may reflect the misplaced presumption that Air India can be privatised). The shocking cynicism with regard to spending on minority affairs in both years may come as no surprise, given the general proclivities of this government.

All this means we must be much more sceptical when listening to the Finance Minister’s Speech and looking at the Budget numbers on 1 February. Unfortunately, most media commentators and stock markets do not seem to have grasped this simple lesson.

(This article was originally published in the Business Line on January 28 , 2020)