State Finances: The looming crisis

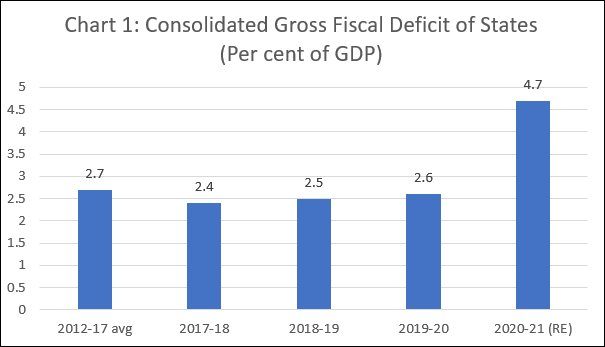

State governments in India are experiencing a fiscal crisis that would adversely impact their development and welfare expenditures in the coming years. As per the revised estimates for 2020-21 collated by the Reserve Bank of India, after averaging 2.7 per cent of GDP over 2012-17 and 2.5 per cent of GDP over 2017-20, the gross fiscal deficit of the states rose sharply to 4.7 per cent of GDP in pandemic year 2020-21 (Chart 1). The revised estimates (RE), which are available towards the end of the fiscal year, have in the past been adjusted downwards when final figures become available with a lag of about a year. But even allowing for that possibility, there can be no doubting the fact that the pandemic, which reduced revenues and increased expenditures, has resulted in a significant increase in the extent of deficit financed spending at the state level. With recovery from the pandemic proving to be anaemic, its effects on revenues are likely to be felt in 2021-22 as well. But enhancing deficit financed spending may not be an option.

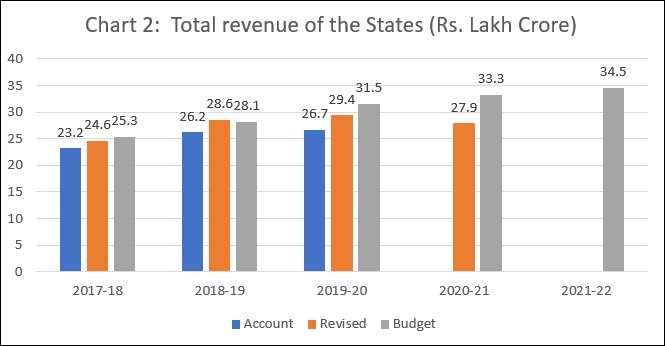

This effect of the pandemic is of even greater concern because of evidence that even in the pre-pandemic year 2019-20, the gross fiscal deficit was kept under control only through a reduction in expenditures, since revenue growth at the level of the states had turned sluggish. Total revenue of 31 states and union territories rose from Rs. 23.21 lakh crore in 2017-18 to 26.20 lakh crore in 2018-19 and was projected to rise to Rs. 31.54 lakh crore in the state budgets for 2019-20 (Chart 2). In practice revenue receipts in 2019-20 stagnated and stood at Rs. 26.70 lakh crore, largely because the transfer of shareable taxes from the Centre to the states fell from Rs. 7.47 lakh crore to Rs. 6.51 lakh crore.

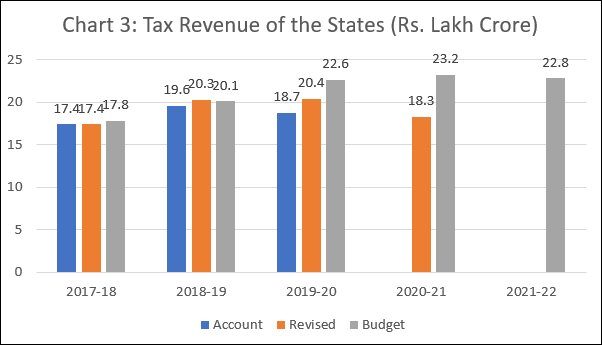

The pandemic and poor collections from the Goods and Services Taxes (GST) regime, made matters much worse in 2020-21. According to the Revised Estimates for 2020-21, the tax revenues accruing to the states fell from Rs. 18.7 lakh crore to Rs. 18.3 lakh crore (Chart 3), even though states’ own tax revenues rose marginally. This decline did not show in total revenue receipts because of an increase in Grants-in-Aid from 5.35 lakh crore to Rs. 7.48 lakh crore. Part of of this increase was because of the compensation for shortfall in GST revenues financed by receipts from the cess imposed for the purpose. However, the Centre refused to cover the shortfall in GST revenues relative to a 14 per cent growth trajectory starting 2015-16 with grants, as originally promised. Part of it was covered with borrowing, transferred as back-to-back loans to the states, which would be serviced in future by revenues derived from an extension of the compensation cess. Compensation through back-to-back loans amounted to Rs. 1.1 lakh crore in 2020-21, whereas compensation with grants financed by the cess was a lower Rs. 91,000 crore. This contributed to the spike in the revenue deficit of the states.

Given the stagnation in revenue receipts in 2019-20, the fiscal deficit that year was kept at 2.6 per cent of GDP essentially by reining in expenditures. The aggregate expenditure of the state governments rose marginally from Rs. 31.25 lakh crore in 2018-19 to Rs. 32.52 lakh crore. This deceleration in growth in receipts and spending prior to the pandemic was the result of a slowdown in growth, which prompted the Finance Minister to offer large tax concessions to the corporate sector in September 2019 to revive investment. That had little effect since the deceleration in growth was the consequence of a demand recession that called for enhanced spending and not tax giveaways. Investment did not revive, but net direct tax collections, or gross direct taxes adjusted for tax refunds, declined in nominal terms from Rs. 11.36 lakh crore in 2018-19 to Rs 10.49 lakh crore in 2019-20, or by close to 8 per cent. That adversely impacted the volume of taxes transferred to the states.

The devastating effect of the pandemic and the brutal lockdowns imposed by the government was superimposed on this decelerating trend. Since most state budgets were prepared before the full effects of the pandemic were felt, state governments had optimistically projected revenues at Rs. 33.31 lakh crore in 2020-21. Provisional accounts show that as a result of the economic contraction in that year, revenue receipts touched only Rs. 26.25 lakh crore. This meant that given the pandemic induced pressure to ramp up spending, state governments needed much more than what they received as compensation from the Centre for GST revenue shortfalls and had to increase their borrowing levels, exploiting the relaxation of the ceiling on borrowing set by the Centre.

This implies that as the states begin to pick themselves up after having been beaten down by the ravages of the pandemic, they would find their debt burden and the associated servicing costs that much higher. This would occur in in environment in which the temporary five-year protection of revenue growth at 14 per cent a year which states had been provided to persuade them to cede their taxing powers to the GST Council would be no more operative, starting July 2022. Though there are some signs of a pick up in GST collections in recent months, levels are far below what a 14 per cent growth would justify. With the Centre likely to reset the ceiling on borrowing to the earlier low levels, expenditure retrenchment at the state level is likely to intensify.

States are in substantial measure responsible for a range of social sector and welfare expenditures. Those expenditures would have to be trimmed in order to address the fiscal crisis, with extremely adverse consequences for the most vulnerable sections of the population. But it is unlikely that such an outcome would reverse the cynical reliance by the Centre on cesses, surcharges and duties that are not part of the divisible pool of taxes to be shared with the states. If the states are unable to meet their welfare commitments, that may not bother parties ruling at the Centre, excepting in states where they are in power. In those contexts, special allocations and transfers may be arranged to address the worst effects. But this cannot work in the long run because an overall economic crisis will follow any fiscal crisis at the state level, and the Centre cannot absolve itself of all responsibility for that eventuality.

(This article was originally published in the Business Line on December 13, 2021)