A ‘Mini-cycle’ in the Commodities Sphere?

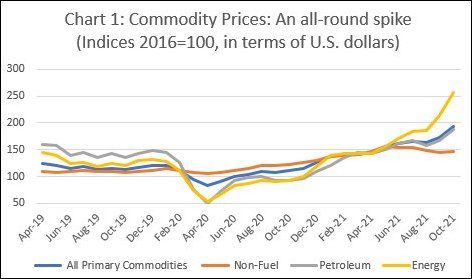

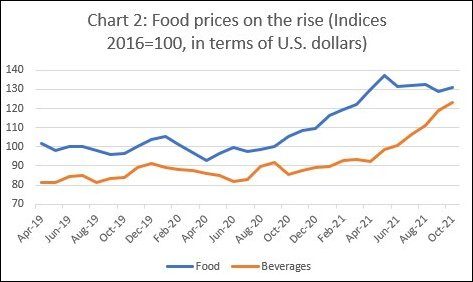

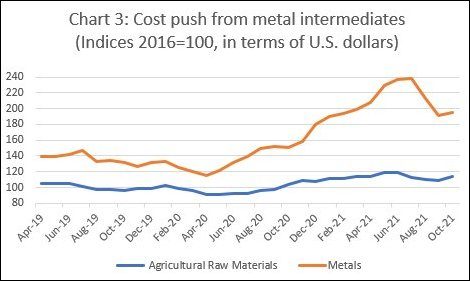

According to the US Department of Labour, consumer prices spiked at 6.2 percent higher in October than a year earlier. The resulting inflation fears are beginning to influence the thinking of central bankers in the developed countries. As that happens, the disparate increases in the prices of primary commodities are receiving more attention. As Chart 1 shows by tracking movements in the IMF’s commodity price indices for different groups, starting from the lows of April 2020, all sets of commodity prices have been rising significantly, though most recently the increase in non-fuel prices seems to be tapering. Besides petroleum and energy, price increases have been sharp both in the food category (more than 40 per cent between April 2020 and October 2021) and in metals (close to 70 per cent over the same period). Prices of agricultural raw materials have been less buoyant, with the increase over this year-and-a-half period amounting to just 25 per cent (Chart 2 and 3).

Oil is the most talked about, with the Brent crude price that had fallen below $20 per barrel in April 2020, when the effects of the pandemic were still severe, now fluctuating in a $80-85 per barrel range. The OPEC+ grouping, which includes Russia, has been raising supply to match the surge in demand that accompanies the withdrawal of pandemic-induced restriction on economic activity. But it is unwilling to succumb to pressures, from the US for example, to go beyond its earlier decision to add 400,000 bpd to the market each month, to soften prices.

On the other hand, high prices do dampen demand growth. OPEC estimates that oil demand will average 99.49 million barrels per day (bpd) in the fourth quarter of 2021, down 330,000 bpd from an earlier forecast. Yet, the pressure to get the most out of available oil reserves before the transition out of fossil fuels gains momentum encourages adoption of measures to manage the supply-demand balance to shore up prices. That is expected to keep prices at high levels for some time.

A second set of prices that is buoyant is that of metals. In this case, besides persistent supply bottlenecks and increased demand driven by a revival of activity as the pandemic wanes, prices are also being driven by expected increases in the demand for the metals that are crucial to the energy transition, in particular copper, nickel, cobalt and lithium. Around 60 percent of copper demand comes from wind and solar technology, electric vehicles and infrastructure. Lithium, cobalt and nickel are crucial to the rechargeable batteries that power a range of devices and electric vehicles. Rising demand, inelastic supply and speculation are pushing up prices of these metals. The price of copper, for example, nearly doubled from around $5000 per tonne in March 2020 to more than $9800 per tonne in mid-November. The increase over the last year was as much as 46 per cent. Investments to enhance the supply of these metals crucial to the energy transition are expected to deliver only in 5-10 years. Meanwhile, rising demand is likely to push up prices significantly. These metals together account for around two-fifths of the weight of all commodities in the IMF’s index for base metal prices.

The other important base metal is iron ore, price trends in which have been more volatile. Having peaked at $233 a tonne on May 12 2021, the price slumped and is fluctuating at around half that level. China’s effort to dampen a speculative construction boom and limit steel output to curb emissions had a knock-on effect on the demand for iron ore, resulting in a quick end to the late-pandemic price surge.

Finally, food prices too have been on the rise. Besides the rise in nominal prices captured in the IMF index reported in Chart 2, the Food and Agriculture Organization’s index of real prices of food (adjusted for inflation) has been rising in the medium term. Real prices today are higher than in 2011. The food basket consists of a range of commodities from cereals to edible oils and sugar. Price movements across these vary. But in most cases, besides the late-pandemic rise in demand, price levels have been affected by adverse and unfavourable weather events like drought. In addition, increases in oil prices have driven up food prices as well, by affecting costs of production and transportation.

Given volatility in supply, especially given weather dependence, the buoyancy in food prices is likely to be treated as a transitory phenomenon. But there are long term effects here as well. The growing demand for biodiesel has diverted supplies of corn, soybean and other agricultural commodities away from the food chain. Increases in their prices result in diversion of land to the cultivation of these commodities, reducing acreage available for other food crops. Depending on the role given to biofuels in the clean energy transition, these could be longer term tendencies. Moreover, there is evidence that, with climate warming, the associated adverse or extreme weather events are increasing. This could have longer term effects on supply, contributing to a core inflationary tendency.

In sum, while the multiple factors driving commodity price increases, especially the late pandemic demand increases and supply bottlenecks, include elements the effects of which on prices are likely to be transitory, there are medium- or long-term influences at work as well. Prices could remain buoyant for some time. Predictions that we are at the beginning of a commodity “super-cycle” may, however be exaggerated. A super-cycle involves an upswing in prices that lasts anywhere between one and three decades. These are rare. There have been only four such in the last 150 years, and the most recent one was witnessed in the early 2000s. So, the likelihood that factors would combine to deliver a similar long term boom so soon after the last one seems low.

But that does not mean that the current commodity price surge would be very short lived. There are factors imparting medium term buoyancy to a range of commodity prices. We may be at the beginning of a “mini-supercycle”. That would be enough to push inflation to levels that force developed country central banks to tighten monetary policy and raise interest rates. Versions of the taper tantrum in countries like India can follow.

(This article was originally published in the Business Line on November 15, 2021)