Bank Credit Post-demonetisation

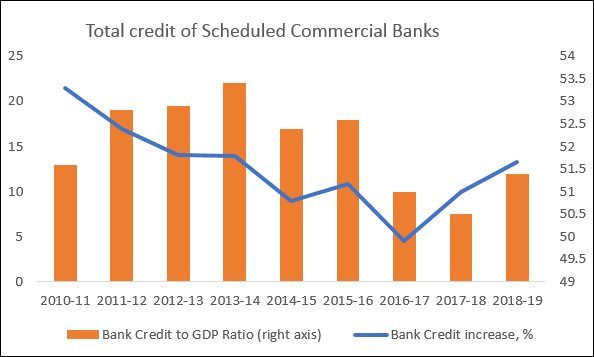

One of the unusual features of the Indian economy relates to the banking sector, with bad loans of commercial banks becoming a serious problem, even at relatively low aggregate credit to GDP ratios by international standards. Figure 1 indicates that even at the peak in 2013-14, aggregate bank credit amounted to less than 54 per cent of GDP, and it has declined relative to GDP quite significantly thereafter. The big collapse occurred in the aftermath of demonetisation in November 2016. But bank credit was already decelerating before then, because of the structural problem of accumulated Non Performing Assets (NPAs) resulting from maturity mismatches and other concerns. This burdened banks and weighed down on their lending.

Demonetisation obviously disrupted banking – and therefore credit – for several months, and forced many borrowers, especially Small and Medium Enterprises, to seek recourse to Non-Bank Financial Companies (NBFCs). But even when the demonetisation could have been said to have run its course, despite some recovery, bank credit to GDP ratios remained well below the average of the first half of this decade.

Figure1: Bank credit has fallen relative to GDP

This has now become one more of the overall problems currently plaguing the Indian economy. Earlier, the overhang of NPAs prevented banks from extending more credit. But now, with greatly depressed domestic demand, it is increasingly recognised that even for those banks that are awash with liquidity, acceptable borrowers are not willing to take on new loans.

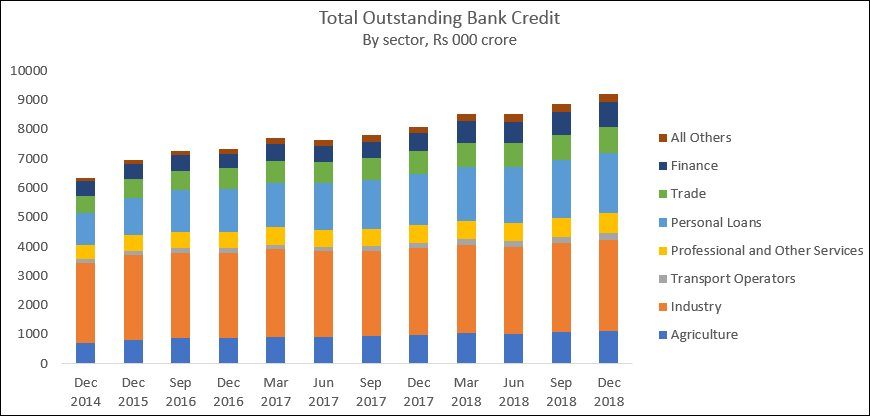

Figure 2 shows the total outstanding bank credit by sector (which covers not only fresh lending but also past loans that have not been repaid). While the relative stagnation of the year after demonetisation comes as no surprise, the lack of much increase thereafter is striking, given the supposedly high rates of nominal GDP growth over this period, it is worth noting how the sectoral allocation of bank credit has changed. While the share of most other sectors remained the same, that of industry dropped and that of personal retail credit increased.

In the period after demonetisation, banks also increased their lending to financial institutions, particularly NBFCs (like the now infamous IL&FS), such that average annual expansion in credit to such financial institutions increased by average annual rates of 22 to 40 per cent in the quarters after demonetisation. However, this remained a relatively small share of total bank credit, at 9.2 per cent in the quarter ending December 2018. However, the NBFCs essentially took on short-term credit as capital to lend long-term. When credit is not rolled over, they face a liquidity crisis; and either must register losses by borrowing from expensive sources or default on payments. That is the crisis now.

Figure 2: Total outstanding bank credit has not increased much

Source: All data from www.rbi.org.in

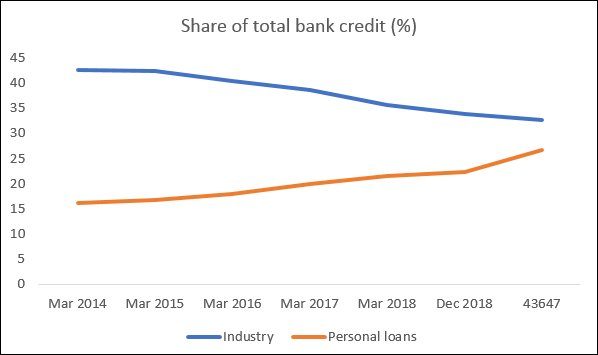

The more striking shift in lending patterns, from industry to personal loans, is evident from Figure 3. Clearly, credit to industry was growing much slower than the rate of growth of nominal GDP over this period. But the rising share of personal loans also points to a worrisome trend: by July 2019, nearly 27 per cent of bank credit was going to retail loans. This actually excludes the significant loans taken for such purposes from NBFCs, which have recently dominantly provided such personal credit, and indicates that household debt exposure has increased significantly in the period since demonetisation.

Figure 3: Personal loans have increased their share of bank credit while

that of industry has declined

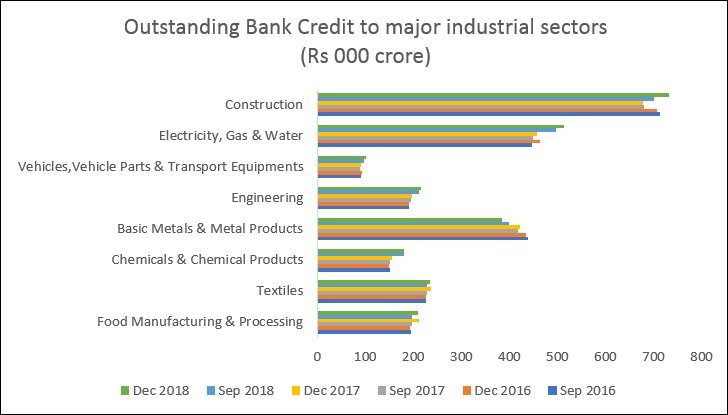

Within industry, which are the sector that have suffered the most in terms of access to bank credit since demonetisation? Figure 4 provides data on the eight sectors that together account for more than 80 per cent of outstanding bank credit. Every sub-sector suffered between September and December 2016, but some have continued to show declines even in nominal outstanding amounts, including basic metals and metal products. Others like vehicles and transport equipment, textiles and food processing have shown almost no increase until December 2018. Credit to construction cam down sharply and appears to have recovered by the end of December 2018, but it is still only 2.5 per cent higher than the level in September 2016. The only sub-sector that has shown a reasonable recovery in terms of credit is electricity, gas and water – but even here, the absolute amount of credit outstanding increased by only 15 per cent between September 2016 and December 2018, a period when nominal GDP would have increased by around double that rate.

Figure 4: Most subsectors of industry have shown very little increase in bank credit

These medium-term trends in bank credit should already have sent warning signals to policy makers in the past few years. They reflect the direct and indirect impacts of demonetisation on the banking sector as well as the real economy, in the context of an economy that had become too dependent on credit for both consumption and investment. It is now evident that even a minor credit squeeze is enough to trigger a recession, given this dependence.

(This article was originally published in the Business Line on September 10, 2019)