External Debt in Asia: Growing pains

The global crisis and subsequent slowdown in imports of advanced economies put a brake on the export-oriented growth of developing Asia, forcing many countries in the region to look for other sources of dynamism. The instabilities and vulnerabilities in the northern markets were clearly the result of the end of the debt-driven bubble in the US and some other European countries, and should have served as a stark warning to other countries to avoid such a volatile trajectory.

Ironically, however, that was not the lesson that was apparently learned by economic policy makers in developing Asia. Instead, to enable recovery from a crisis that was marked by the busting of a credit bubble, Asian governments chose to push their own markets to expand on the basis of growing debt rather than rising wage incomes. Much of this was domestic debt, especially directed towards retail credit for housing and real estate, and to the bank credit to the construction industry. China provides the most striking example of this, with debt-to-GDP ratios more than doubling for all sectors: households, corporates, provincial governments. But debt also increased sharply in several other Asian countries.

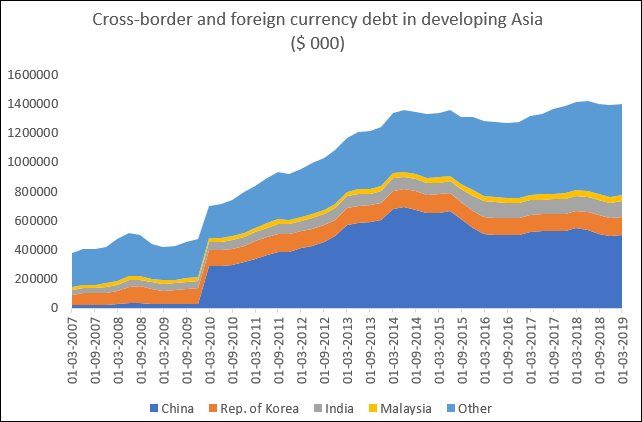

The rapid increase of external debt in the past decade has been less commented upon, but this is significant because external debt can provide an additional source of vulnerability for these developing countries. Figure 1 indicates just how rapid this increase has been. Total cross-border and foreign currency denominated debt of Asian developing economies increased from $375 billion at the end of the first quarter of 2007 to $1.394 trillion by the first quarter of 2019.

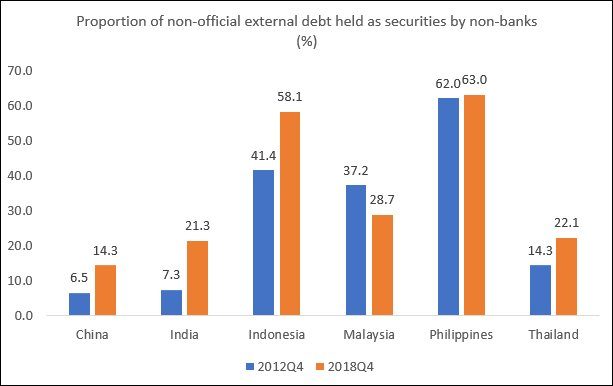

What is more, a significantly greater share of this external or foreign-currency denominated debt is not just held by banks as credit in the traditional pattern: much more of it is now in the form of bonds held by private non-bank investors. Figure 2 gives some indication of this shift for particular countries. By the last quarter of 2018, the share of total external debt held as securities by non-banks increased was 58 per cent in Indonesia and 63 per cent in the Philippines. In Thailand it had increased to 22 per cent from 14 per cent six years previously, while for India the increase was from 7 to 21 per cent over the same period.

Figure 1: External debt increased dramatically in developing Asia from 2010

Source: www.bis.org

Figure 2: Private bond holders hold more of Asian debt

Source: www.bis.org

Why should this be a concern? Essentially this can be a problem because bond markets are notoriously fickle and can experience large swings on relatively small changes in perception. Bond market sell-offs can be rapid, and have caused both balance of payments and fiscal problems whenever they occur, as the battered countries of the eurozone periphery can testify. So developing countries with such exposure can experience problems at much lower levels of debt to GDP ratios.

This sudden increase in external debt levels is not only the result of greater policy willingness in development Asia to accept such debt. It also reflects global push factors, most of all the long period of loose monetary policies in the form of more liquidity provision (quantitative easing) and very low interest rates in the advanced economies. Because of these policies, the world is now awash with liquid finance seeking higher returns wherever possible, and Asian economies have been among the major recipients of this mobile capital.

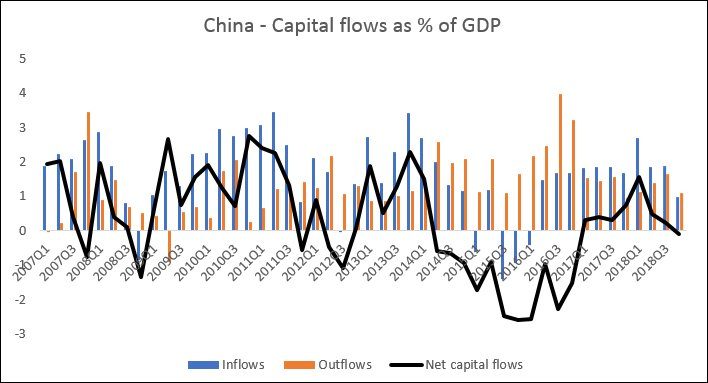

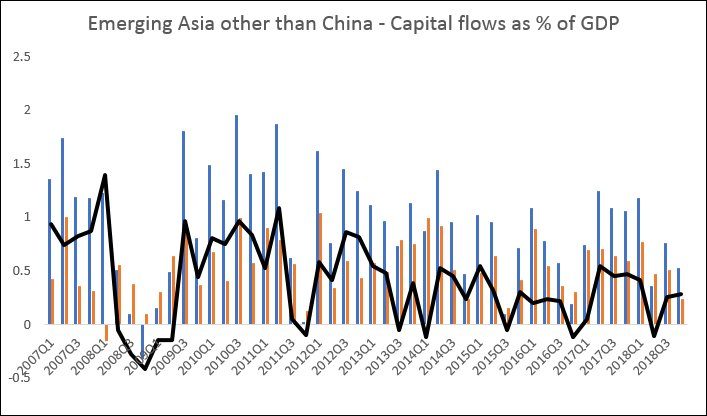

Indeed, the risks inherent in such reliance have been evident as net cross-border capital flows have become more volatile and turned close to negative for many Asian countries. Figures 3 and 4 provide evidence of this volatility in China and in other Asian developing and emerging economies.

Figure 3: Net capital flows of China have only just stabilised after declines

Source: www.imf.org

Figure 4: Net capital flows in other Asian economies have been close to zero for a while now

Source: www.imf.org

Net outflows from China have occurred in several periods since 2008, but they were quite significant between early 2014 and mid 2017. Since then they appear to have stabilised, largely because the Chinese government brought in various capital controls to prevent or reduce capital flight. It should be noted that China still retains man more weapons in its economic arsenal to combat such capital account volatility.

But the rest of the Asian region as a whole also shows decreasing net inflows – and these countries mostly do not have the same instruments of control at their disposal, or at least have chosen not to use them. They are therefore much more at risk of being adversely affected by sudden outflows, including by bond holders. And this is often for no reason connected with their own economies, but because of policy changes and other events in the North.

This means that, in addition to the uncertainties in the Asian region created by the ongoing trade war between the US and China, there are real and growing concerns about the capital account and external debt vulnerability of several Asian economies.

(This article was originally published in the Business Line on August 13, 2019)