What explains High Global Wheat Prices?

High global prices of food items, especially essential food grains, have terrible consequences around the world, with those living in lower-income food-importing countries typically the worst affected. It is often assumed that when such prices rise, it is the result of changing supply conditions for example, changing climate patterns that affect sowing and harvest, or particular shocks (like the Ukraine War) that reduce production and exports of major exporting countries, or affect transport links between exporting and importing countries.

There is no doubt that these can indeed be factors, but in fact their significance tends to be greatly overplayed. Indeed, it is likely that they have been much less significant in explaining recent price increases in global food trade than other relatively new forces: significant market concentration that has increased the power of global agribusinesses to set prices; and financial speculation in commodity futures markets that in turn affects the spot prices for actual sale.

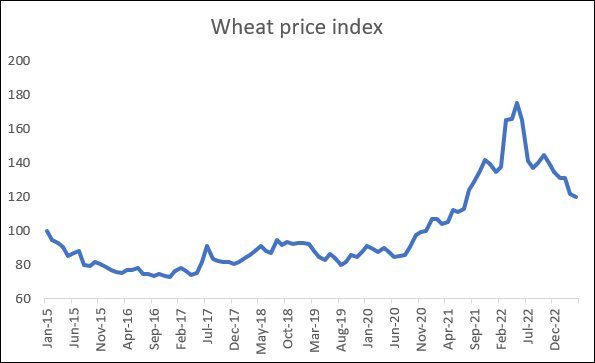

This is evident in the recent behaviour of wheat prices in global trade. Figure 1 plots the monthly movement of wheat prices in global trade, with January 2015=100. All data used here are based on the International Grain Council estimates, as published in the FAO’s AMIS Market Monitor over various issues. It should be noted that these estimates are broadly aligned with other estimates of the USDA and the FAO’s own AMIS (Agricultural Market information System).

Between January 2015 and September 2020, global what prices fluctuated around a mostly stagnant trend. However, wheat prices started rising from October 2020, going up by around one-third over the subsequent year. By December 2021, wheat prices were 40 per cent higher than a year earlier. At the time, this was largely ascribed supply constraints because of the Covid-19 pandemic, as it was assumed that aggregate demand for food grain had not increased.

Thereafter, wheat prices exploded dramatically after Russia’s invasion of Ukraine in February 2022. The price increases were rapid and sharp: between January and May 2022, wheat prices increased by more than 30 per cent. This was widely blamed on the Ukraine War, which involved two major exporters of wheat, Ukraine and Russia. In 2021, Russia was the largest wheat exporter in the world, and Ukraine the fourth largest, and together their wheat exports accounted for more than a quarter of global supply.

Much was made of the Russian blockade of ports that would prevent Ukraine from exporting wheat, with a Black Sea Grain Initiative created specifically to try and address this. And sanctions against Russia imposed by the US, European Union and some allies, were meant to ensure that Russian wheat would also not be as readily available for the global market. This is the context in which it was almost taken for granted by many that there would inevitably be a significant increase in wheat prices.

Figure 1

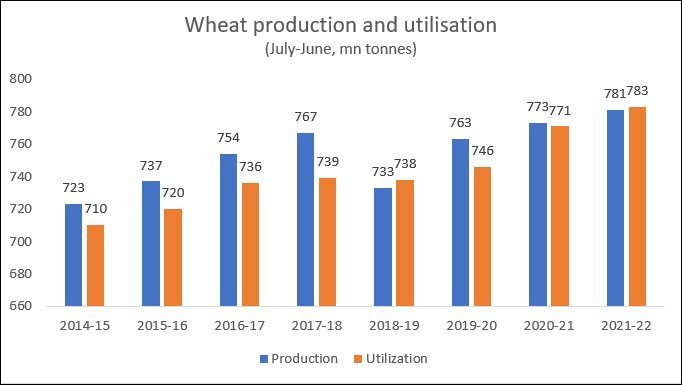

Figure 2

But this should never have been a convincing argument. Wheat is produced globally, and so shortages in one part of the world can be compensated for by more production in another, and so it is never wise to look only at events whether war or weather and climate shocks or trade route disruption in one part of the world alone. Indeed, as Figure 2 show, total global production in the period July 2021-June 2022 did not decrease; rather it increased, going up from 773 to 781 million tonnes. While utilisation of wheat over the period (a proxy for demand, which includes food use, feed use, other uses, exports and closing stocks) was slightly higher than total production, it was only marginally so, with the difference being only 2 million tonnes.

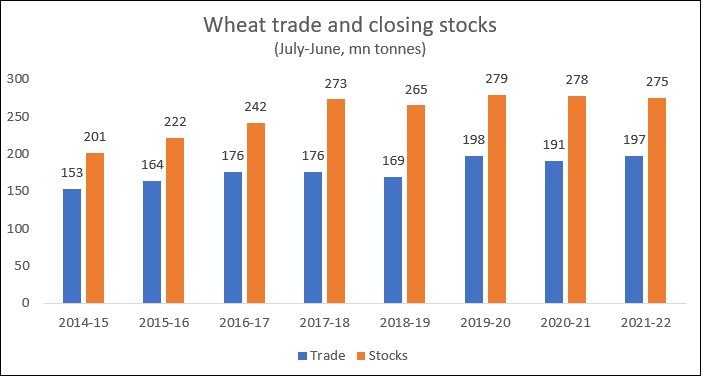

Figure 3

Nor was wheat trade affected in terms of absolute amounts traded. Figure 3 indicates that the total amount of wheat traded in global markets actually increased by 6 million tonnes over the previous period. In other words, the Ukraine War appears to have had a negligible effect on both production and utilization, and even been associated with an increase in the volume of wheat traded in global markets.

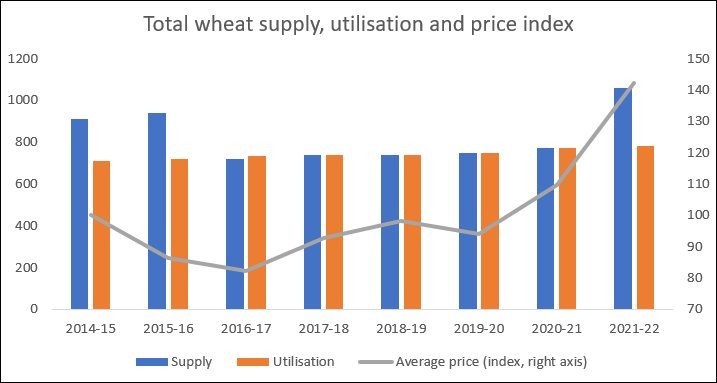

This makes the dramatic increase in prices over this period counterintuitive. If the “fundamentals” of supply and demand were not driving prices upwards, then what exactly has been going on? Figure 4 makes the question even more obvious, juxtaposing global wheat supply, utilisation and average annual price over the years. (Supply includes opening stocks, production and imports, aggregated across countries.) It is clear that the price increases in 2020-21 and 2021-22 bore no relationship to the relationship between supply and use of wheat; indeed, in 2021-22, supply significantly exceeded utilisation.

Figure 4

So what has been going on in global wheat markets? One piece of evidence that is worth noting is the sharp increase in profits of the major global grain traders. Only four companies (Archer-Daniels-Midland Company, Bunge, Cargill and Louis Dreyfus, together known as ABCD) control anywhere between 70 and 90 per cent of the global grain trade. All of them registered significant profit increases in 2021, and the largest of them, Archer Daniels Midland, increased its profits by 74 per cent in April-June 2022 compared to the same quarter in the previous year. This was supposedly because of “high demand for grains and tighter supplies following Russia’s invasion of Ukraine”, but as we have seen, neither of these actually occurred! Instead these large agribusinesses were able to increase their prices at will because of the widespread public perception that these must be justified.

Similarly, financial activity in commodity futures markets became particularly marked in the second quarter of 2022, affecting futures prices and thereby exercising upward pressure on spot prices for wheat. Such speculation was observed in the past, particularly over 2007-09 in what was then known as the Global Food Crisis. But it had been assumed that new regulations in the US and the EU (through the US’ Dodd-Frank Act and the EU’s EMIR-MIFID laws) would be operating to limit such activity. It is now clear that such regulations were not enough and can be relatively easily bypassed.

What this indicates is that global food markets and global financial markets both need much greater regulation, if we are to prevent damaging food price increases that are not based on fundamentals but allow private corporate enrichment at the expense of human suffering.

(This article was originally published in the Business Line on June 26, 2023)