Public Spending in India

India is an outlier in terms of low government spending during the pandemic, as we noted last month in an earlier article. Unlike advanced economies and even most developing and emerging market economies, the Indian government did not ramp up public spending to enable its population to cope with the public health disaster and the massive livelihood losses resulting from a mishandled pandemic. Instead, as we showed, central government spending actually declined in the pandemic year 2020-21, according to the government’s own report to the IMF.

Now that the Union Budget for 2022-23 is soon to be presented, the concerns about inadequate public spending are even more pressing. We do not yet know the actual spending of the central government beyond November 2021, nor what additional expenditure they made choose to make in the remaining part of this fiscal year. But the signs so far are not encouraging.

The CSO’s recently released advance estimates of GDP, which are explicitly intended “to serve as essential inputs to the Budget exercise” provide some indications of how the fiscal stringency of the pandemic year played put in terms of macroeconomic indicators. Admittedly, these data should be used with extreme caution. The CSO admits that the estimates are “based on limited data and compiled using the Benchmark-Indicator method i.e., the estimates available for the previous year (2020-21 in this case) are extrapolated using relevant indicators reflecting the performance of sectors.”

To these caveats must be added the well-known problems of relying on indicators like the financial performance of listed companies for estimating output in industry and some services. This method does not factor in the economic performance of micro, small and medium enterprises or self-employed people, all of which have suffered disproportionately during this period. There are therefore reasons to suspect that these may be over-optimistic estimates.

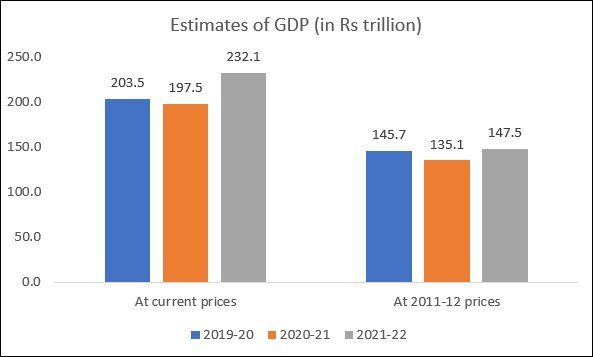

Even so, the estimates are sobering. Figure 1 show the recent and projected trends of GDP. There has been much talk of a V-shaped recovery, but even this upward-biased projection presents real economic output as still below the level of the pre-pandemic year. (All data from the CSO Advance National Income Estimates 2021-22.) It is likely that when (if?) informal economic activity is properly accounted for, this too will emerge to have been an overestimate.

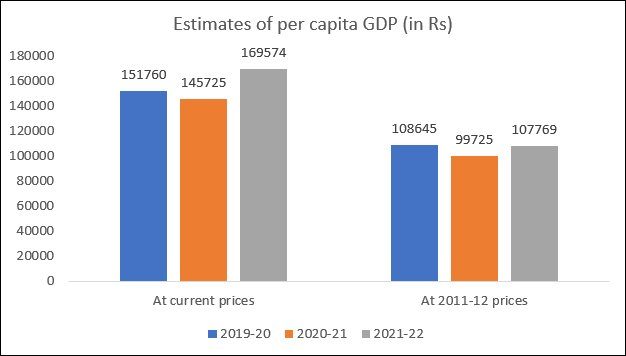

Meanwhile, as Figure 2 makes clear, per capita income has deteriorated over this period. We know that not only is income distribution very unequal in India, but it has also greatly worsened during the pandemic – as suggested both by the World Inequality Report 2022 and the India supplement to the Oxfam report “Inequality Kills”. The latter reveals that when 84 percent of households in the country suffered a decline in their income in a year marked by tremendous loss of life and livelihoods, the number of Indian billionaires grew from 102 to 142. Sales of luxury cars and other signs of affluent living by the rich in India increased by many multiples in the year when job loss, falling incomes and growing hunger became the norm for the vast majority of Indians.

Figure 1

Figure 2

In such an increasingly unequal context, stagnant average incomes point to significantly worsening incomes of the bottom half of Indians, and probably 90 per cent of the population. This is clearly terrible from a welfare perspective, but it also has major macroeconomic implications. An economy of India’s size cannot be sustained for very long by demand from a tiny minority of privileged large companies and wealthy individuals. In addition, the consumption of the rich tends to be more import-intensive than mass consumption, which means that less of it will contribute to domestic demand. At some point, therefore, the impoverishment of the mass of people inevitably reflects in declining domestic demand, which in turn impacts negatively on domestic sales and profitability of even the large capital that is currently benefiting at the expense of smaller enterprises.

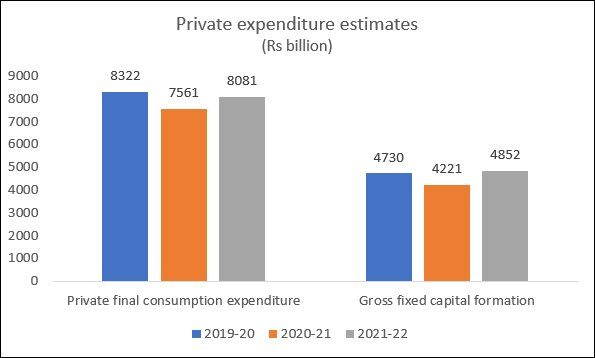

Figure 3

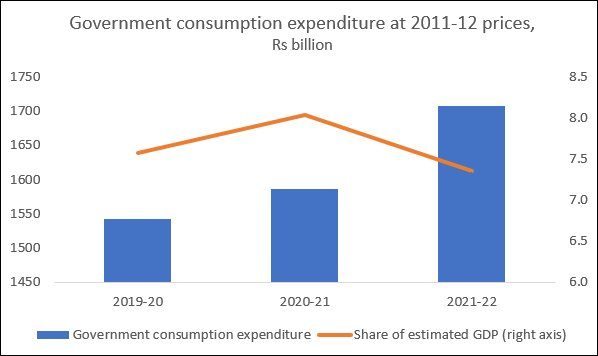

Figure 4

This process of declining mass consumption demand was already evident before the pandemic struck, but it has further worsened since March 2020. Figure 3 shows how total private final consumption expenditure fell by nearly ten percent in 2020-21 compared to the previous year, and even in 2021-22 is estimated to have remained below the level of two years earlier.

Partly as a result of this, capital formation (investment) also declined in 2020-21. The apparent recovery of investment in 2021-22 was relatively minor. It is possible that some of this could reflect private investors’ response to rising exports, as the rest of the world recovered faster than India and enabled export revenues to increase faster than domestic sales.

It is obvious that in such a context of stagnant of falling private demand, it is essential for the government to step up its spending to counterbalance this tendency of declining economic activity. We do not know the contribution of public investment to gross capital formation, but total government consumption spending—which should have increased massively during the pandemic as it did in almost all other countries in the world—remained relatively low.

Figure 4 provides estimates of total public consumption spending (in constant 2011-12 prices) by both Centre and States. We know that the increase in 2020-21 was entirely due to state government spending as, by its own admission, central government spending declined in absolute terms over 2020-21. The projected increase over the current year (which could well be based on budget estimates rather than actual patterns) is nowhere near enough to compensate the fact that conditions for the majority of Indians remain extremely dire as the successive Covid-19 waves have played havoc with both health and economic activity. It is of great concern therefore that total public consumption spending is estimated to have declined as a share of GDP in 2021-22.

This brings us to the concerns about public spending that should come to the fore in any assessments of Budget 2022-23. The first numbers to look out for are those of actual spending by the Central government so far in this fiscal year. Unfortunately, even revised estimates do not provide an accurate cue for this, since they are presented when two months of the fiscal year still remain. But already, there are signs of significant underspending (even relative to Budget estimates) in crucial areas like health, the rural employment programme, essential social services like food provision, the ICDS and social protection programmes. Allocations to these crucial areas really should be dramatically increased.

The other numbers that matter include overall levels of public spending and the extent of proposed transfers to states, which have borne the brunt of dealing with the pandemic fallout. If commentators really want to focus on the possibilities for a stable and equitable economic recovery, they must go beyond the usual finance-driven obsession with the fiscal deficit to looking at these numbers.

(This article was originally published in the Business Line on January 24, 2022)